AML Name Screening is one of the risk assessment methods for existing or potential customers of an organization subject to AML obligations.

Businesses should use AML screening software to scan their current and potential customers for sanctions, PEP, blacklists/wanted lists,

and unwanted media data. Businesses should use AML screening software to scan their current and potential customers for sanctions,

PEP, blacklists/wanted lists, and unwanted media data.

Anti-money laundering screening is a key component of anti-money laundering

compliance

(a) Businesses are required to perform name screen when on boarding customer to comply with anti-money laundering regulations. (b) Risk levels for existing customers may change over time. Therefore, companies should regularly check them through name screening. (c) Businesses should use The Ultimate Beneficial Owner to scan the organizations/individuals they wish to do business with. (d) While making transactions- Allows screening transaction data against sanction list databases and detecting risk throughout beneficiaries, senders, and other data elements

Name screening systems contain two purposes. The first purpose is to create a risk assessment.

Risk assessment is critical as it helps entities identify high-risk customers and take necessary measures to monitor their financial activities.

Know Your Customer (KYC), Customer Due Diligence (CDD), and Enhance Due Diligence (EDD) are other compliance programs that help companies create risk assessments.

The second purpose of name-checking is to help entities to identify and report suspicious activity.

Businesses that fail to comply with anti-money laundering regulations will face penalties.

Therefore, companies use name screening software to scan their customers' sanctions lists, PEP lists, and adverse media data.

AI insights offer a quick and secure route to compliance. Globally, organizations face regulatory pressure to maintain strong sanctions compliance programs. Transaction screening forms part of this regulatory requirement and one of the primary functions of a robust compliance program Benefits of Live Ex Transaction Screening

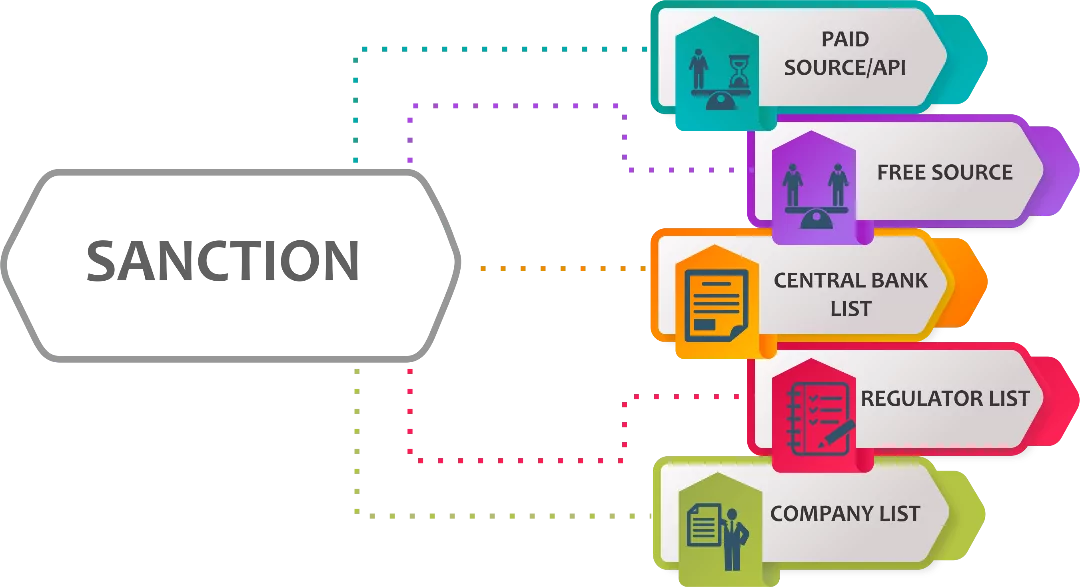

Sanction screening is a very important tool in the fight against ML/TF in the UAE. Sanction screening refers to the process of reviewing customer details in

various sanctions lists to check whether the customer is involved in any money laundering activities or terrorism related activities.

Ready-to-use LiveEx-Shield Transaction Screening is easy to use and quick to implement in your compliance environment.

The solution automatically compares transactions to sanctions lists in real-time and provides a complete audit trail of all user and system-generated actions as

you guide clicks through the workflow. Dashboard Reporting Our dashboard provides compliance team leaders with a top-down view of key screening activities.

Team leaders can easily view the current filtering configuration and the customers with the highest click-through rate.

The dashboard also provides a graphical view of

team activity and workflow, highlighting any backlog, workload, and performance issues. Efficient Alert Review Process Data is automatically highlighted for review,

so analysts can immediately see what needs to be investigated. Also, all customer and information data can be checked from one dashboard. Bulk actions and keyboard

shortcuts simplify workflow management by reducing the time it takes to complete reviews. Enhanced matching capabilities Natural language processing and advanced

matching algorithms reduce false positives, allowing analysts to focus on true alerts. Live Ex's deal screening matching engine provides powerful cross-language

support and language-ability matching tools in 18 languages, including Simplified Chinese and Arabic.

The system automatically suggests matches that may be based

on Localization, nicknames and synonyms to increase alert rates. Built-in sandbox for testing filtering configurations Live Ex’s transaction filtering sandbox

allows analysts to fine-tune filtering configurations based on results from real data before making changes to the live environment.

This enables analysts to understand the impact of changes and provide a direct comparison to the current configuration

Automate Your Screening process Effectively

We live in a technological era, and manual methods waste time for businesses. Our AML Screening solution, built with cutting-edge technology, accelerates and simplifies customer risk screening and monitoring. Our database contains sanctions, PEP, and negative media data from over 200 countries. Companies that use our AML screening software can thus perform a global comprehensive risk control.

Our product supports manual queries, batch queries, and API queries. Companies that offer API integration run their query processes automatically in the background. As a result, the customer on boarding process is not delayed, and AML obligations are met.

As per the governance guidance the sanction screening matrix designed based on the three lines of defense, frontline and direct support functions within

business units constitute the first line of defense and are accountable for identifying, mitigating and managing sanctions risk associated with

customers/products/services and all other stakeholders, compliance is the second line of defense to review the generated alerts and identifying

the False Positive and Potential Matches on real time to ensuring that adequate and robust systems addressing sanctions risk while monitoring, supporting and advising/training the business unit in this regard including releasing of false positives and raising STRs if warranted.

The system has additional methodology to add search freeze notices from the regulators.

Contact usCopyright © LiveEx Shield Corp. 2021