A comprehensive tool to monitor all transactions, ensuring risk-based business segments and thresholds are in place based on regulatory typology assessments.

A well-defined Transaction Monitoring

Program is an important component of an effective AML & CTF program. Monitoring refers to the monitoring of customer transactions,

including assessing historical / current customer information and interactions to provide a complete picture of customer activity.

Weak or Poorly designed Transaction Monitoring System may lead the organization to Non-Compliance Charges from the regulators.

LiveEx TMS provides a risk-based approach to monitoring the customer behavior and transactions. The LiveEx TMS system provides the

flexibility to active and inactive the rules from menu driven user interface. The TMS System is configured with identifying of abnormal / unusual

transactions, patterns of activities and behaviors of customers.

Transaction monitoring solutions enable financial establishments to watch their customer’s transactions in real time and/or on a daily basis. These solutions do not only

view current transactions, but also analyze customers' historical information and account profiles. From there, an analysis of the customer can be provided,

which can include risk levels and predicted future activity. This can include transfers, deposits, and withdrawals. Mostly all financial institutes will

use software to automatically analyze this data.

You may have been on the receiving end of transaction monitoring before. Have you ever received a phone call from your bank asking you to

confirm certain purchases? That is because, thanks to transaction monitoring, your bank has a general idea of your normal financial activity.

If they notice unusual behavior, they can report it (such as suspected credit card theft), or to the authorities if they think its criminal activity.

Transaction laundering could be a newer sort of money crime which may be prevented by adequate transaction observance; however we’ll dive into that a touch later.

Basically, transaction laundering happen once a criminal offers one thing dirty available on-line below the color of a legitimate and legal product.

Criminal’s source measure believed to be wash billions of Dollars once a year through this technique.

First, transaction monitoring is an important first step in any financial institution's AML and CTF procedures. Being able to spot suspicious transactions could potentially prevent thousands or millions of dollars from being laundered by criminals. No organization wants to be involved in a money laundering scandal. In addition, transaction monitoring gives regulators and banking partner’s confidence. This shows that financial institutions take AML and CTF regulations seriously and are doing everything possible to prevent criminal activity. This builds trust between new and/or existing partners. Transaction monitoring additionally permits financial establishments to take a risk-based approach. This means they are able to identify and manage potential risks for their clients. There are many factors that determine a client's level of risk, such as: B. Type of employment, country of residence, etc. Once a financial institution has determined a customer's risk level, it can adjust monitoring of that customer. For example, low-risk customers do now not require as much transaction monitoring as high-risk clients. Depending on where they are placed and the segments and merchandise they serve, some companies want to take a riskier method to all customers.

Across the board, automated -controlled group action watching is much superior to manual group action watching. It’s implausibly time intensive (and expensive) to undertake and plan to produce a manual group action news system. Humans even have a way larger capability to create errors than a chosen package can. However, there's still a manual facet to automatic dealing observation so as for it to be actually triple-crown. As an example, an observation package might flag a suspicious dealing for associate worker to appear at and verify if it's so suspicious. Real individual’s square measure required to confirm that package is functioning because it ought to be False positives are often a difficulty once victimization an automatic dealing watching answer. The software package must be capable enough to follow distinctive rules for various sorts of purchasers. If the foundations aren’t correct, then too several false positives can occur, which may produce a backlog of terribly tedious work for workers. A financial organization will like better to build their dealing watching software package in-house or hunt for a 3rd party answer. If developing an answer in-house, it's going to be necessary to usher in associate professional in compliance associated risk to form an economical program. Whatever you decide on, there square measure one or two of things to stay in mind. The flexibleness and measurability of an answer is of utmost importance, because the laws encompassing dealings observation square measure perpetually dynamical. In addition, it’s vital to be able to produce Associate in Nursing audit path of all activity to own a transparent understanding of what's happening, and to probably show to the relevant authorities.

September 8, 2021 ANTI-MONEY LAUNDERING AND COMBATING THE FINANCING OF TERRORISM AND ILLEGAL ORGANISATIONS GUIDANCE FOR LICENSED FINANCIAL INSTITUTIONS ON TRANSACTION MONITORING AND SANCTIONS SCREENING.

An effective TM program enables LFIs to detect, investigate, and report suspicious transactions, in compliance with the UAE’s legal and regulatory framework,

and to ensure that the institutions’ customers and transactions remain within their risk appetite. Effective TM therefore depends critically on information

obtained through the application of customer due diligence (“CDD”)/know your customer (“KYC”) measures, including but not limited to information regarding the types of

transactions in which the customer would normally be expected to engage. Obtaining a sufficient understanding of its customers and the nature and purpose of the customer

relationship, together with the ongoing analysis of actual customer behavior and the behavior of relevant peer groups, allows the LFI to develop a baseline of normal or

expected activity for the customer, against which unusual or potentially suspicious transactions can be identified.

TM compliance personnel should escalate for priority

remediation any identified omissions or inaccuracies in relevant customer or beneficial ownership information or gaps or data quality issues in required transaction or payment

message fields. An effective TM program consists of the following core elements

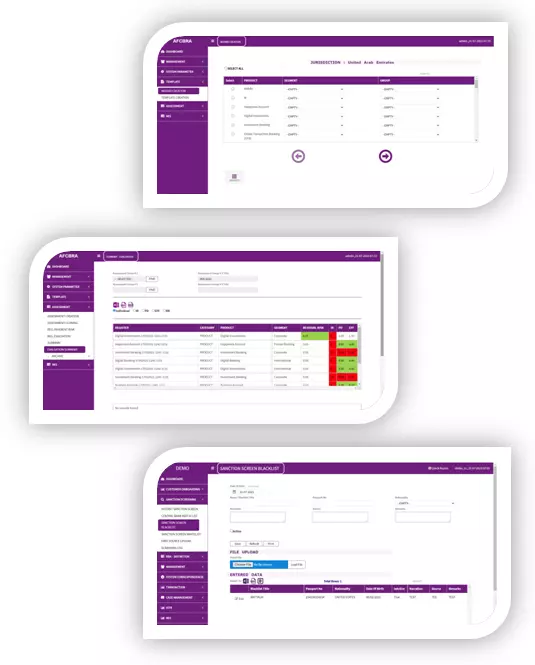

A well-calibrated risk-based framework

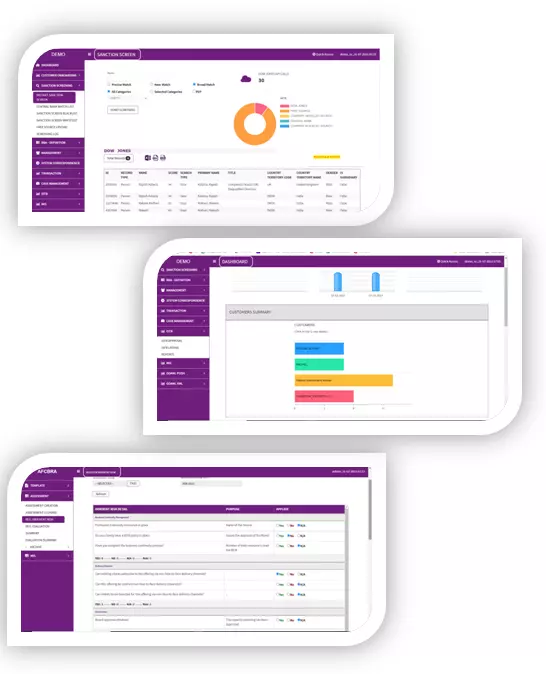

LiveEx TMS System offers, the Money Laundering Reporting Officer (MLRO) can customize the monitoring rule according to the nature of the business.

The TMS parameters are controlled by the MLRO and easy to explain to the regulators at any time.LiveEx TMS has Multiple Dashboards based on the set rules

which will reduce the reporting entity manual work and it will help to reduce the cost in man power usages.

The LiveEx TMS System has the modules of Quality Review, Case Management, Investigation and Escalations, Automated Email Facilities, Customer Profile Monitoring, etc.…

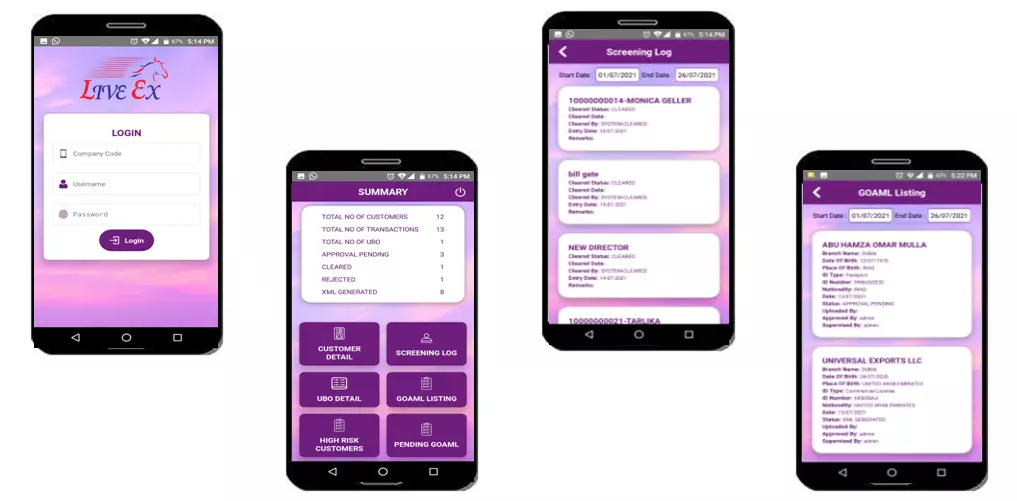

Manage your Transaction Monitoring Wherever You Are: The LiveEx system provides an attractive mobile apps to monitor the transaction on real time.

The Target of LiveEx TMS is to help and improve the organization AML/CFT Compliance Framework as per the National and International Standards.

Write to us on admin@circuitcomputer.com and our experts will get in touch with you to explain.

The TMS parameters are controlled by the MLRO and easy to explain to the regulators at any time.

LiveEx TMS has Multiple Dashboards based on the set rules which will reduce the reporting entity manual work.

Manage your Transaction Monitoring Wherever You Are: The LiveEx system provides an attractive mobile apps to monitor the transaction on real time.

The Target of LiveEx TMS is to help and improve the organization AML/CFT Compliance Framework as per the National and International Standards.

Contact usCopyright © LiveEx Shield Corp. 2021